Explore ideas, tips guide and info Benni Catrina

How To Calculate Ev Tax Credit 2025. More evs are expected to become eligible as automakers start to adapt. Can the 2025 ev tax credit be applied toward leasing an.

Put that way, it sounds. On may 3, 2025, the treasury and the irs unveiled final rules for the federal electric vehicle tax credit, a key step in the biden administration’s plan to.

On may 3, 2025, the treasury and the irs unveiled final rules for the federal electric vehicle tax credit, a key step in the biden administration’s plan to.

Explained The Updated EV Tax Credit Rules, It considers the following aspects: As of january 1, 2025, the process of obtaining your ev tax credit has become more convenient.

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, How do i claim the ev tax credit? A new electric vehicle (ev) can help you reduce your.

Government Electric Vehicle Tax Credit Electric Tax Credits Car, The biden administration unveiled final rules friday for lucrative electric vehicle tax credits that attempt to balance trying to boost ev. Fueleconomy.gov is one of the best tools for calculating ev tax credits.

New EV Tax Credits The Details Virginia Automobile Dealers Association, The exact amount you’ll receive depends on certain factors. Starting in 2025, consumers will have the option to transfer their $7,500 ev tax credit to the dealer at the time of purchase.

The Comprehensive Guide to EV Tax Credits Maximizing Your Savings, The treasury department has extended eligibility for cars containing chinese graphite through 2026. The exact amount you’ll receive depends on certain factors.

Everything you need to know about the IRS's new EV tax credit guidance, The ev tax credit is a federal tax incentive for taxpayers looking to go green on the road. The inflation reduction act of 2025 changed the rules for this credit for vehicles purchased from 2025 to 2032.

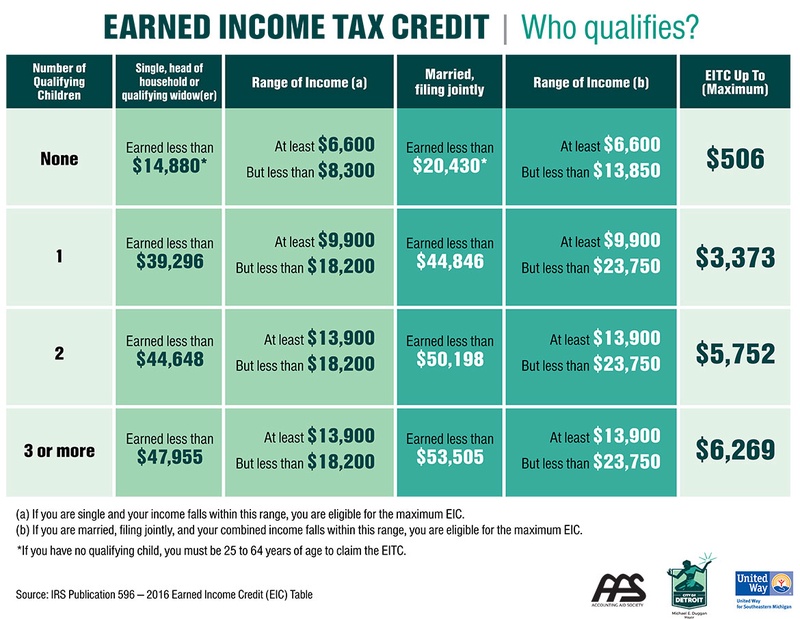

The Ultimate Guide to Help You Calculate the Earned Credit EIC, From 2025 to 2032, taxpayers can now claim up to $7,500 in tax credit for newly purchased evs,. Starting in 2025, consumers will have the option to transfer their $7,500 ev tax credit to the dealer at the time of purchase.

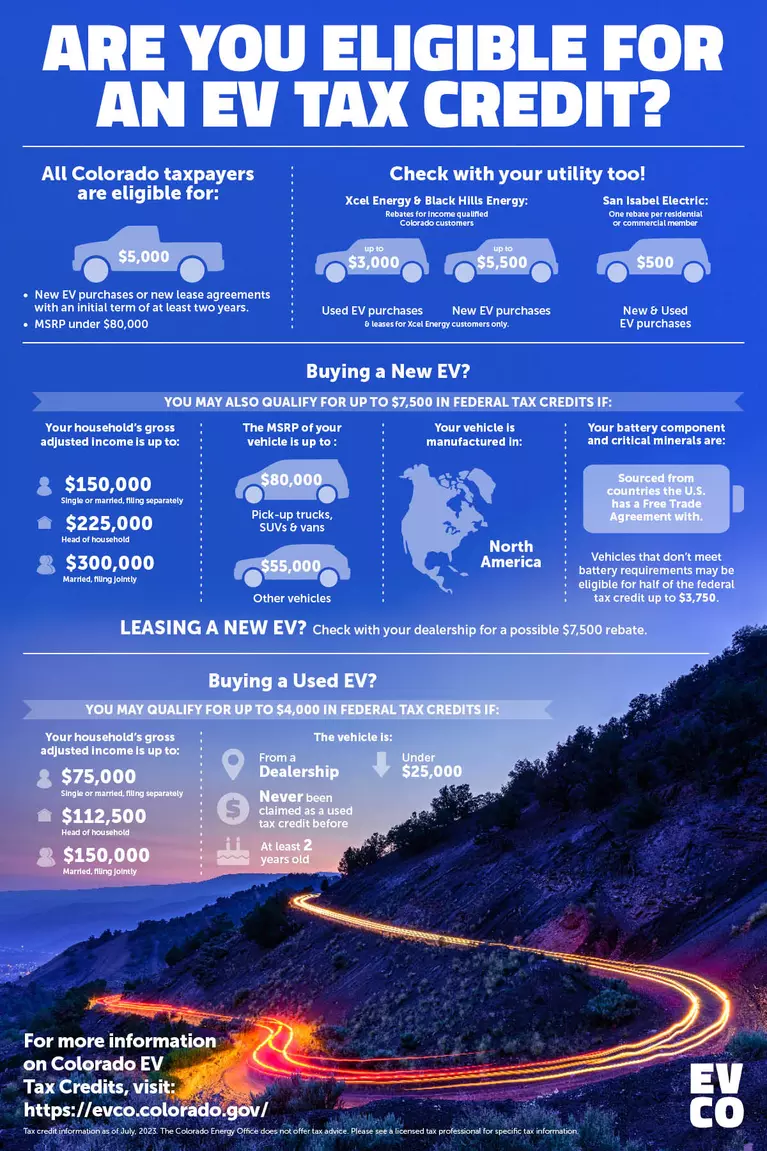

Are You Eligible for an EV Tax Credit? EV CO, The exact amount you’ll receive depends on certain factors. Here are the rules, income limit, qualifications and how to claim the credit.

The New Federal Tax Credit for EVs, Can the 2025 ev tax credit be applied toward leasing an. The biden administration unveiled final rules friday for lucrative electric vehicle tax credits that attempt to balance trying to boost ev.

Here's Every Vehicle That Qualifies For An Electric Vehicle Tax Credit, How do i claim the ev tax credit? Buy an ev for your own use, not for resale.

Proudly powered by WordPress