Ky Income Tax Rate 2025. A report published this month found that kentucky did not meet conditions put in place by the legislature to allow lawmakers to cut the state income tax again next. It’s the first glimpse of how continued cuts to the state’s.

Kentucky’s individual income tax rate is set to remain the same in 2025 after the state failed to meet certain fiscal requirements. Calculate your income tax, social security.

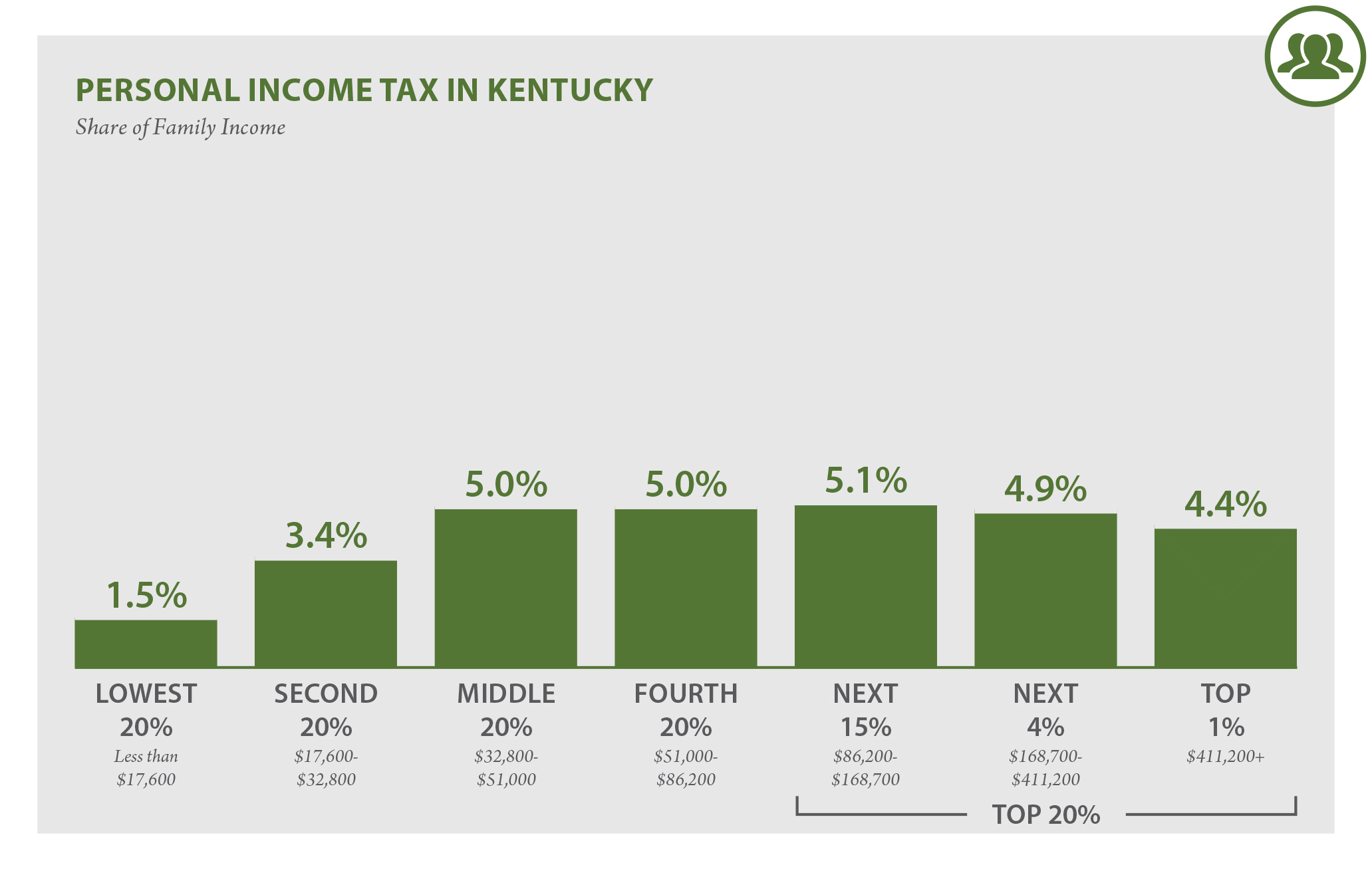

Kentucky has a flat income tax of 5% — all earnings are taxed at the same rate, regardless of total income level.

kentucky tax calculator Risa Mize, Kentucky is one of the first states in 2025 to. A report published this month found that kentucky did not meet conditions put in place by the legislature to allow lawmakers to cut the state income tax again next.

T200018 Baseline Distribution of and Federal Taxes, All Tax, (ap) — kentucky's individual income tax rate is set to remain the same in 2025 after the state failed to meet certain fiscal requirements that would have ushered in another. In 2025, the general assembly began a march toward the elimination of kentucky’s income tax.

What Is Kentucky State Tax Rate LiveWell, A law passed in 2025 automatically cuts kentucky's income tax by half a percentage point each year if the state meet certain. For taxable years beginning on or after january 1, 2025, the income tax rate may be reduced according to the annual process established in subparagraphs 2.

Kentucky Tax Calculator 2025 2025, South africa tax calculator 2025, the minister forecast an increase of 7.6% in tax revenue from r1,73 trillion (for the fiscal year ending 31 march 2025) to r1, 863 trillion (for the. Kentucky’s individual income tax rate is set to remain the same in 2025 after the state failed to meet certain fiscal requirements.

Kentucky misses a fiscal trigger for personal tax rate cut in 2025, The highest tax rate would be 30. Kentucky's income tax rate was lowered from 5% to 4.5% this year and will fall to 4% in 2025, but will stay at 4% in 2025 after the state failed to meet certain fiscal.

T200040 Average Effective Federal Tax Rates All Tax Units, By, Our current rate is 4.5 percent, but on january 1, 2025, kentucky’s individual income tax rate will fall to just 4 percent. Kentucky has a flat 4.00 percent individual income tax rate.

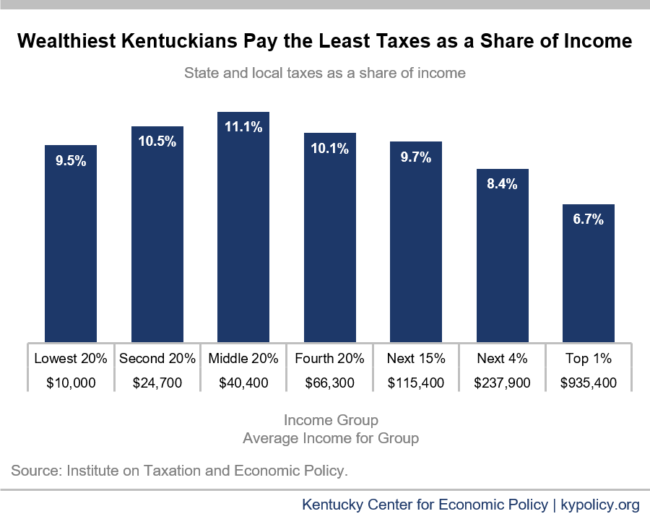

Kentucky Who Pays? 6th Edition ITEP, You can click on any city or county for more details, including the nonresident income tax rate. These rates are effective july 1, 2025 and were set in accordance.

Tax Rates 2025 2025 Image to u, A law passed in 2025 automatically cuts kentucky's income tax by half a percentage point each year if the state meet certain. Kentucky's income tax rate was lowered from 5% to 4.5% this year and will fall to 4% in 2025, but will stay at 4% in 2025 after the state failed to meet certain fiscal.

Kentucky Enacts Personal Tax Rate Reduction Harding, Shymanski, For taxable years beginning on or after january 1, 2025, the income tax rate may be reduced according to the annual process established in subparagraphs 2. Kentucky is one of the first states in 2025 to.

Tax Rates 2025 To 2025 Image to u, The 2025 tax rates and thresholds for both the kentucky state tax tables and federal tax tables are comprehensively integrated into the kentucky tax calculator for 2025. Kentucky tax brackets for tax year 2025.

The government has retained it at 25 percent to ease the tax burden on taxpayers, according to the amended finance act.

(ap) — kentucky’s individual income tax rate is set to remain the same in 2025 after the state failed to meet certain fiscal requirements that.