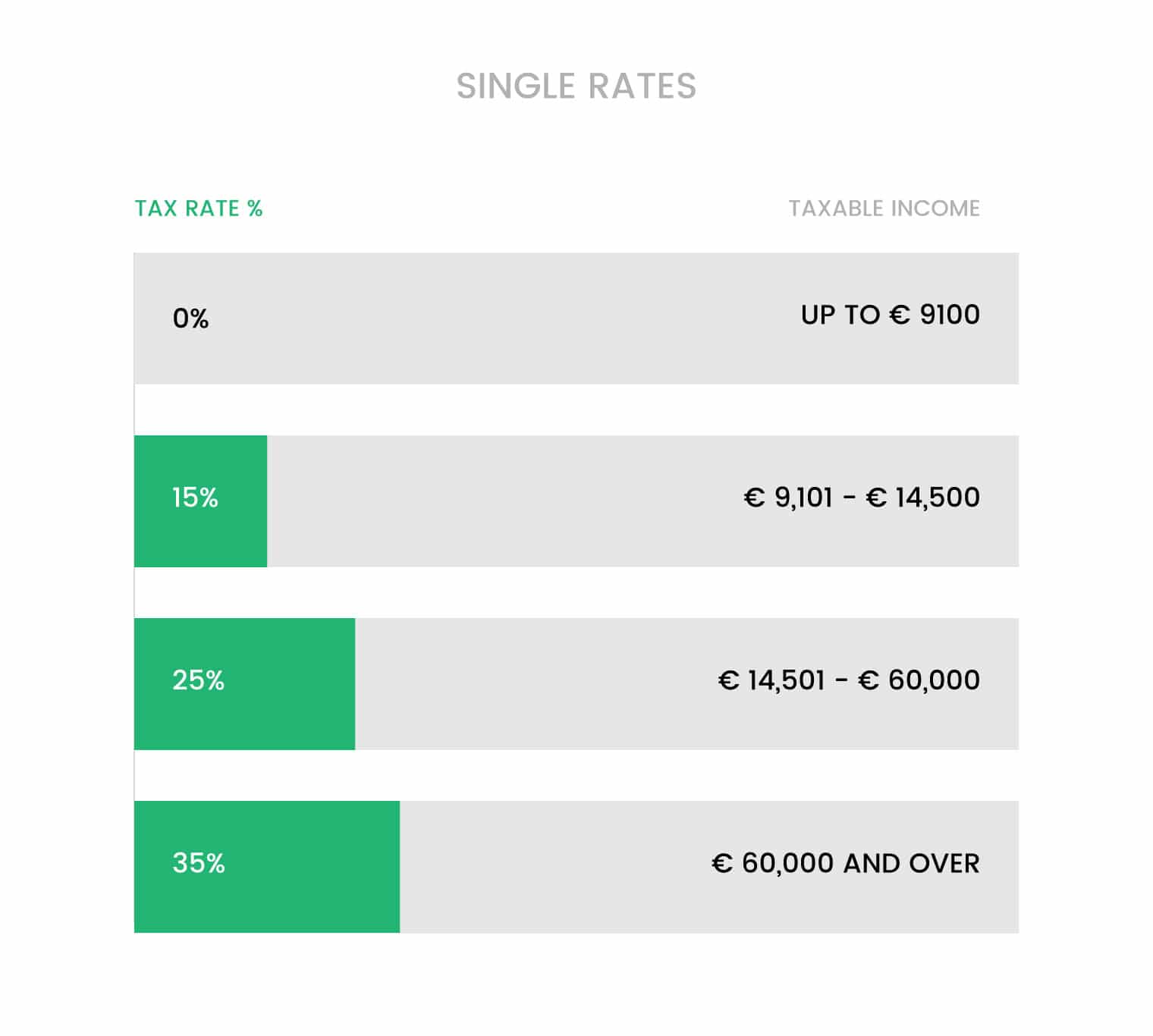

Tax Rates 2025 Malta Calculator. The konnekt salary and tax calculator is a new simple tool that gives you a comprehensive overview of your salary while employed in malta. Malta operates a progressive tax system, with rates ranging from 0% to 35%.

Calculate your income tax in malta and salary deduction in malta to calculate and compare salary after tax for income in malta in the 2025 tax year. It takes into account a.

Tax Calculator 2025 Malta Caryn Cthrine, Malta salary calculator is a free and easy to use tool to calculate your all tax rates in malta and salary income in malta on a daily, weekly and monthly basis.

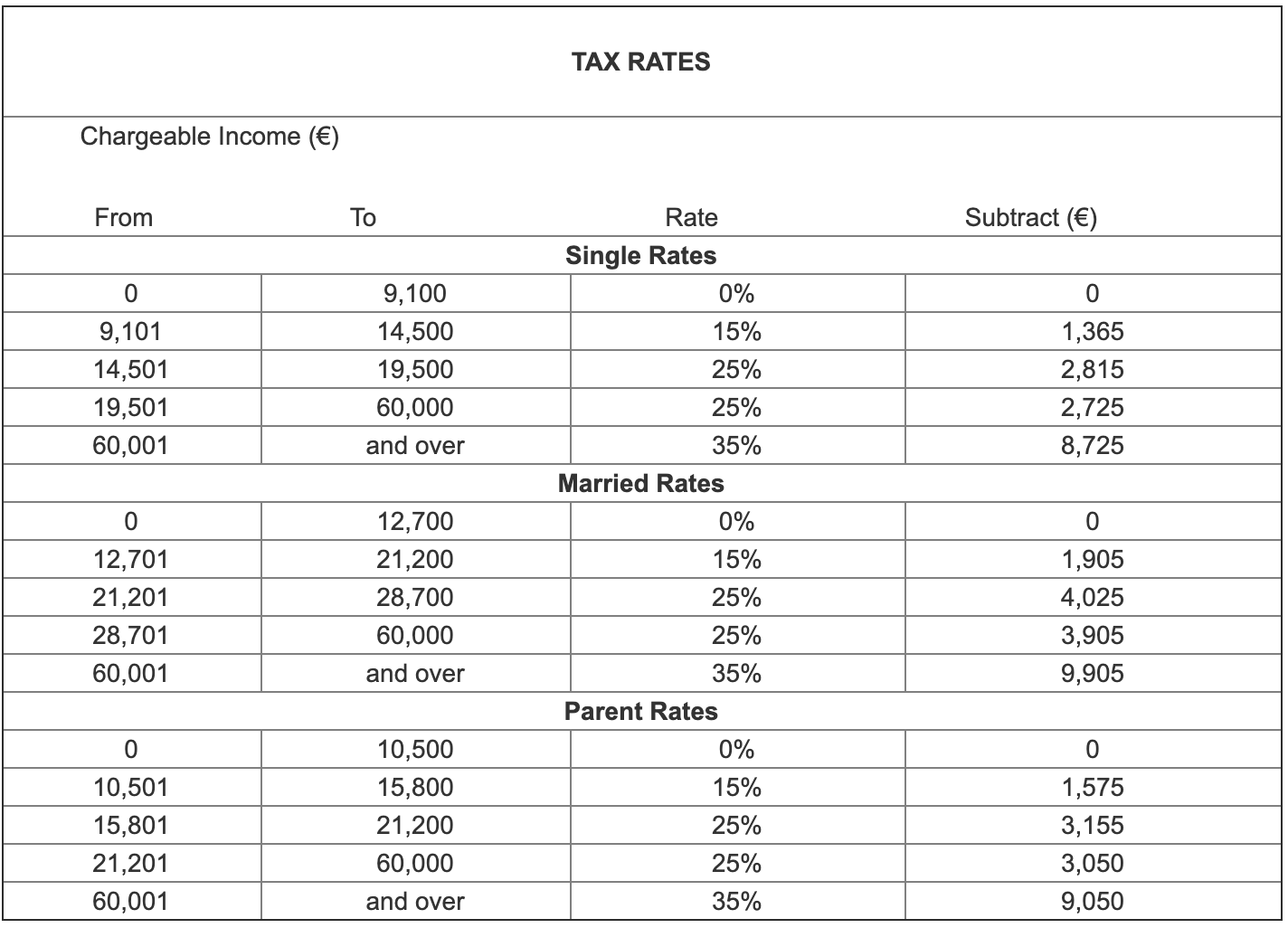

Tax Calculator 2025 Malta Tobey Gloriana, Income is taxable at graduated progressive rates, ranging from 0% to 35%.

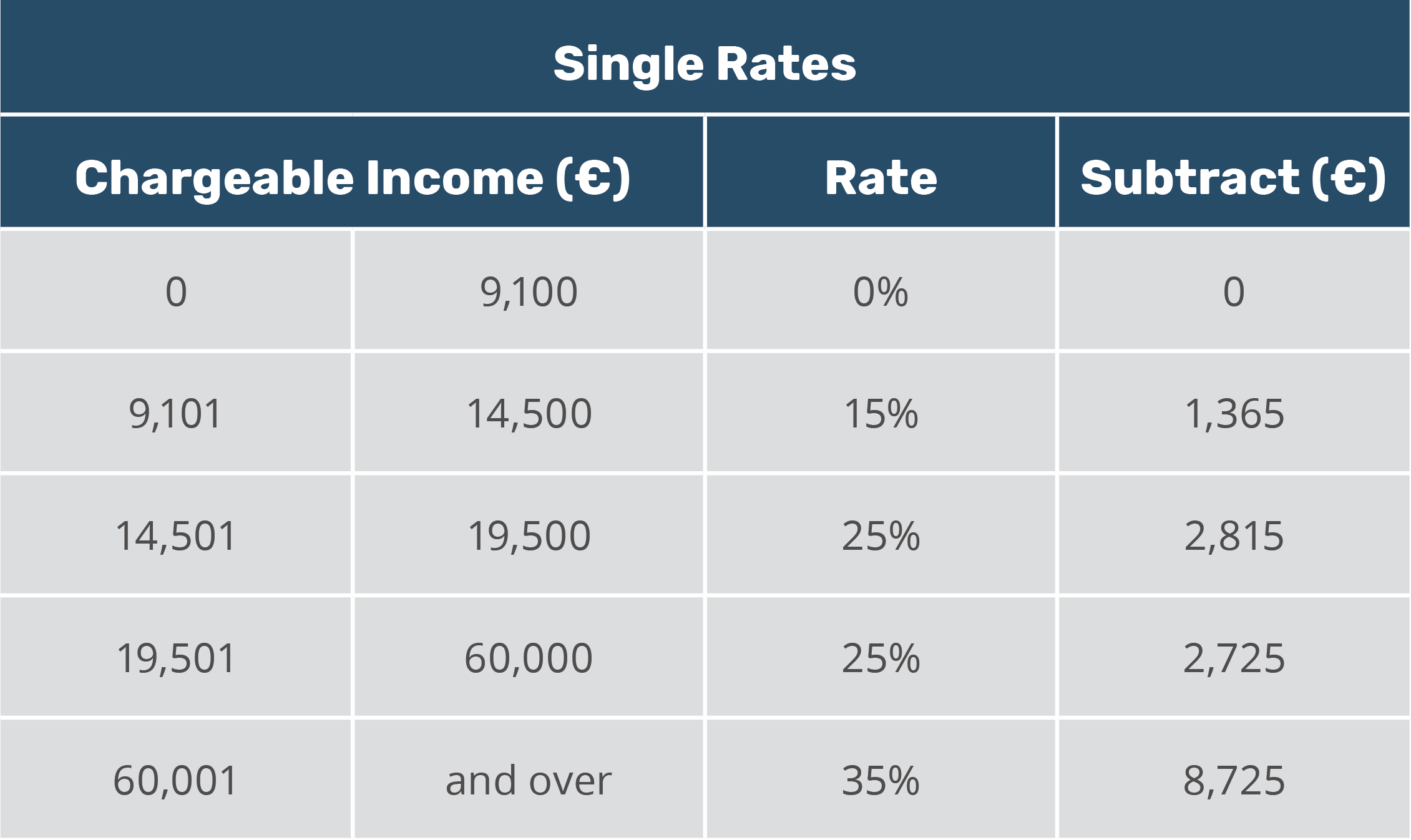

Single Tax Rates 2025 Malta Alana Michelle, The 35% tax bracket is reached at annual chargeable income in.

Malta Annual Tax Calculator 2025 Annual Salary After Tax Calculator, Find out your net salary and get a detailed tax breakdown (including income tax, social security, and health contributions) with our malta salary calculator.

Malta Monthly Tax Calculator 2025 Monthly Salary After Tax Calculator, Tax rates chargeable income (€)

Single Tax Rates 2025 Malta Brina Claudie, Maltatoday is unveiling a new salary calculator aimed at helping readers understand how this year’s income tax adjustments could impact their salaries.

Malta Tax Tables 2025 Tax Rates and Thresholds in Malta, Calculate your income tax in malta and salary deduction in malta to calculate and compare salary after tax for income in malta in the 2025 tax year.

Single Tax Rates 2025 Malta Alana Michelle, Malta operates a progressive tax system, with rates ranging from 0% to 35%.

Malta Tax Rates 2025 Image to u, Broadwing employment agency is offering a free tool to calculate your weekly, monthly, or yearly net salary based on the tax rates in malta.